Let’s get real about passive income. The internet is flooded with “gurus” promising you’ll make thousands while sleeping, but we all know that most methods require either significant upfront capital, technical skills that take years to develop, or aren’t actually passive at all.

As someone who’s spent way too many hours researching and testing various passive income streams (my search history is basically “how to make money without working” on repeat), I’m here to share the methods that genuinely work in 2025, without the empty promises.

1. Digital Product Creation: The Gift That Keeps on Giving

Creating digital products might require substantial effort upfront, but once they’re done, the same product can be sold infinitely with minimal additional work.

What’s working in 2025:

- Digital templates: Whether it’s resume templates, social media graphics, or budget spreadsheets, people will pay for well-designed tools that save them time. The beauty here is that you create it once, set up a Gumroad or Etsy shop, and the sales can continue for years.

- Ebooks and guides: That knowledge you’ve accumulated about your hobby or profession? Package it into a comprehensive guide. The key is addressing specific problems rather than general topics – “Ultimate Guide to Fixing a Leaky Toilet Without a Plumber” will sell better than “Home Maintenance Tips.”

- Printables: Planners, wall art, stickers, and organizational tools are selling like hotcakes. Many people still prefer physical copies but are happy to print them themselves.

Reality check: It can take 3-6 months to start seeing consistent income. You’ll need to put effort into marketing initially, but once you build momentum and positive reviews, sales become much more passive. Most successful creators have multiple products rather than relying on just one hit wonder.

Pro tip: Create complementary product suites. If someone buys your budget template, they might also want your debt payoff tracker or investment calculator. The more products you have solving related problems, the higher your average customer value becomes.

2. Content Creation With Long-Term Royalties

Content that continues generating income long after publication is the holy grail of passive income.

What’s working in 2025:

- YouTube channel monetization: While building a successful channel isn’t passive initially, established channels with evergreen content continue generating ad revenue for years. Educational content, how-to videos, and niche explanations have particularly long shelf lives.

- Stock content licensing: Photos, videos, music, and illustrations submitted to platforms like Shutterstock, Adobe Stock, or Epidemic Sound can generate royalties whenever someone licenses your work. The key is volume—successful contributors typically have hundreds or thousands of assets available.

- Print-on-demand merchandise: Creating designs for t-shirts, mugs, and other merchandise that platforms like Printful, Redbubble, or Merch by Amazon produce and ship when orders come in. You just need to upload designs and set up listings.

Reality check: All content platforms take time to gain traction – expect 6-12 months before seeing meaningful income. Also, these platforms frequently change their algorithms and payment structures, so diversification across multiple platforms is essential.

Pro tip: Instead of chasing trends, focus on evergreen topics that people search for consistently. A YouTube video about “How to Fix a Running Toilet” will get views year after year, while content about fleeting trends fades quickly.

3. Real Estate Investment Without Being a Landlord

Real estate remains one of the most reliable passive income sources, but traditional property ownership is neither passive nor accessible to many. Thankfully, new options have emerged.

What’s working in 2025:

- REITs (Real Estate Investment Trusts): These publicly traded companies own, operate, or finance income-producing real estate across various sectors. When you buy shares, you’re essentially investing in a portfolio of properties without the headaches of ownership. Many REITs pay dividends quarterly.

- Crowdfunded real estate: Platforms like Fundrise, RealtyMogul, and Groundfloor allow you to invest in real estate projects with as little as $10-100. You receive proportional returns from rental income or property appreciation without dealing with tenants or toilets.

- Fractional ownership platforms: Companies like Arrived and Roofstock One allow you to buy partial ownership in single-family rental properties. They handle property management while you collect your share of rental income and appreciation.

Reality check: Returns typically range from 5-12% annually, depending on the investment type and risk level. Real estate investments should generally be viewed as medium to long-term plays – don’t expect to withdraw your money quickly without penalties.

Pro tip: Start small with crowdfunding platforms to learn the ropes before committing larger sums. Many platforms offer automated investment options where your returns are automatically reinvested, accelerating your passive income growth through compounding.

4. Automated E-commerce Systems

E-commerce has evolved beyond the old dropshipping model that required constant product hunting and customer service.

What’s working in 2025:

- Print-on-demand automation: Beyond just listing designs, advanced automation tools now allow you to connect design generation (sometimes AI-assisted) with market research tools that identify trending niches and automatically deploy designs to multiple platforms.

- Fulfilled-by-Amazon (FBA) with automated restocking: While setting up an Amazon FBA business requires upfront work, new inventory management tools can automate reordering based on sales velocity, ensuring you stay in stock without daily management.

- Digital product stores with AI customer service: Using advanced chatbots to handle common customer questions about your digital products reduces the time spent on customer service by up to 80%.

Reality check: E-commerce still requires initial product research, setup, and occasional oversight. The most successful automated e-commerce businesses typically take 3-6 months to establish and fine-tune before becoming truly “hands-off.”

Pro tip: Documentation is your friend. Create detailed standard operating procedures (SOPs) for every aspect of your e-commerce operation. This makes it easier to troubleshoot when issues arise and simplifies the process if you eventually want to outsource management to a virtual assistant.

5. Dividend Investing: The Classic That Still Works

While investing in dividend stocks isn’t new, improved tools and platforms have made dividend investing more accessible and strategic than ever.

What’s working in 2025:

- Dividend ETFs: Rather than picking individual dividend stocks, Exchange-Traded Funds (ETFs) like SCHD, VYM, or DGRO give you instant diversification across many dividend-paying companies.

- Dividend growth investing: Instead of chasing the highest current yields (which can be risky), focus on companies with consistent dividend growth histories. Tools like Track Your Dividends or Simply Safe Dividends help identify companies likely to increase payouts over time.

- Dividend reinvestment plans (DRIPs): Automatically reinvesting dividends to purchase more shares creates a powerful compounding effect that accelerates passive income growth.

Reality check: Building significant dividend income requires substantial capital. A $1,000 investment in a portfolio yielding 4% generates just $40 annually. To earn $1,000 monthly ($12,000 annually) at a 4% yield, you’d need a portfolio worth $300,000.

Pro tip: Many brokerages now offer fractional shares, allowing you to invest specific dollar amounts rather than buying whole shares. This makes it easier to maintain a balanced dividend portfolio even with limited capital. Also, consider setting up automatic transfers to your investment account; even small regular contributions add up significantly over time.

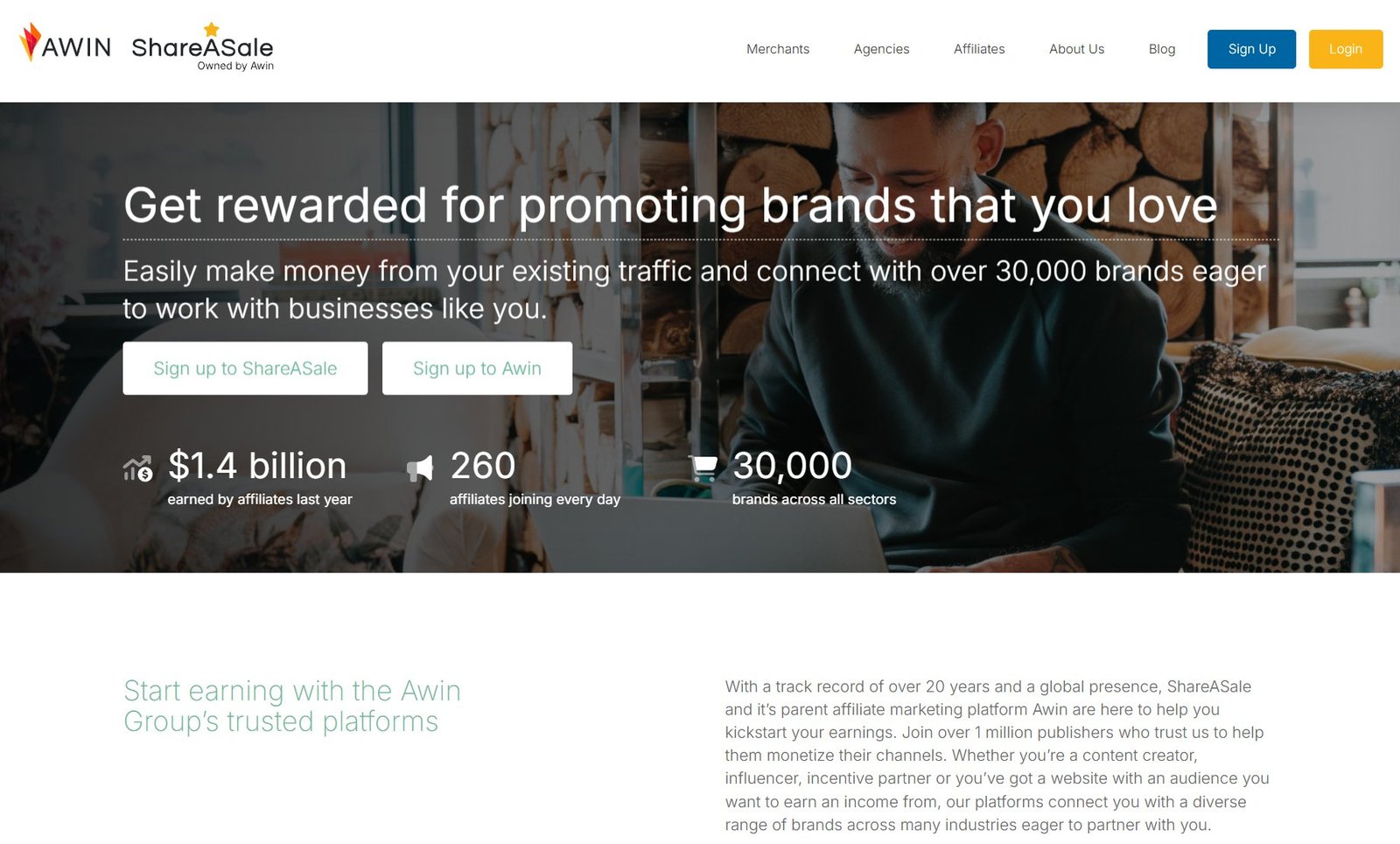

6. Affiliate Marketing (The Sustainable Way)

Forget the spammy affiliate marketing of yesterday. Today’s successful affiliate marketers build authority platforms that generate commissions for years to come.

What’s working in 2025:

- Niche comparison websites: Creating detailed, honest comparisons between products or services in a specific niche. Once ranked in search engines, these pages can generate commissions for years with minimal updates.

- Resource libraries: Building comprehensive resource pages around specific topics that naturally incorporate affiliate links. For example, a “Home Office Setup Guide” could include affiliate links to recommended chairs, desks, lighting, etc.

- Email course automations: Creating automated email sequences that provide genuine value while strategically recommending relevant products throughout the learning journey.

Reality check: Effective affiliate marketing requires building trust with your audience, which takes time. Most successful affiliate sites take 6-12 months to start generating meaningful revenue. You’ll need to regularly update content to maintain search rankings and ensure product recommendations remain current.

Pro tip: Focus on promoting products with recurring commissions whenever possible. A single recommendation for a subscription service can generate commissions month after month for years, as long as the customer remains subscribed.

7. Automated Crypto Strategies

While cryptocurrency remains volatile, structured approaches to crypto investing have become more accessible and potentially passive.

What’s working in 2025:

- Staking rewards: Many cryptocurrencies offer staking rewards (similar to interest) for helping secure their networks. Platforms like Lido and Rocket Pool have simplified the staking process even for non-technical users.

- Liquidity providing: Supplying assets to decentralized exchanges in return for a portion of trading fees. While once complex, platforms like Uniswap and Curve have made this increasingly user-friendly.

- Yield farming automation: Tools that automatically move your crypto assets between different protocols to maximize yield, handling the complex rebalancing that would otherwise require constant monitoring.

Reality check: Crypto remains high-risk and volatile. Never invest money you can’t afford to lose, and consider crypto as just one piece of a diversified investment strategy. Regulatory changes can dramatically impact returns, so stay informed about evolving regulations.

Pro tip: For those new to crypto, consider allocating just 5-10% of your investment portfolio as you learn the space. Focus on established projects with clear utility rather than chasing the newest tokens with promised high returns.

The Truth About “Passive” Income

Here’s what no one wants to admit: Truly 100% passive income is rare. Most methods require either:

- Significant upfront work before becoming passive.

- Ongoing maintenance and updates.

- Substantial capital investment.

- Some combination of all three.

The most successful “passive” income earners typically:

- Build multiple streams rather than relying on just one method.

- Gradually transition from active to passive by systemizing and automating.

- Reinvest early returns to accelerate growth.

- Accept that some monitoring and maintenance will always be necessary.

The good news? Once established, these income streams typically require just a fraction of the time that a traditional job demands; often just a few hours weekly to maintain multiple sources.

Getting Started: The Right Mindset

If you’re new to building passive income, here’s your action plan:

- Choose based on your resources: If you have more time than money, start with content creation or digital products. If you have capital but limited time, dividend investing or real estate platforms make more sense.

- Start small and focused: It’s better to fully implement one passive income strategy than to dabble superficially in several. Get one stream working before adding another.

- Document everything: Create systems from the beginning. Document your processes so they can eventually be automated or outsourced.

- Set realistic expectations: Give your passive income streams adequate time to develop – most take at least 6-12 months to gain momentum.

- Value sustainability over quick wins: The most reliable passive income methods build gradually but last for years or decades.

Remember, the best time to start building passive income was years ago. The second-best time is today. Even small steps compound dramatically over time.

What passive income methods are you currently exploring? Drop a comment below, I love hearing about new approaches and success stories!